Contents

The only indication from ATR’s is that higher ATRs can mean a stock is trending, and lower ATRs could indicate a consolidation in price. Whether the stock is trending up or down, the range is always positive. This is because as such, ATR can be used to validate the interest behind a move or breakout.

Remember that in the future you may see a lot of paid IO scripts called BuySellScalper, Trend Trader Karan, Trend Trader and etc which will be based on this script. E) Trading / Trading in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. The range of a day is simply the high minus the low, this was the extent to which price was able to traverse during the day. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited. Stock moves from a period of low volatility to high volatility .

The indicator aids in the placement of orders and can be used as a trailing stop loss. The average true range is an N-day smoothed moving average of the true range values. Wilder proposed ATR in his 1978 book, New Concepts in Technical Trading Systems. Volatility is the possibility of changes in the stock price due to fluctuations over a period of time.

Investment Methods

If the volatility of a stock increased, it was entering a trend, and if it slowed down, it suggested a reversal. He further refined the trading range, calling it a true range when he included changes in price that occurred from the previous day’s close rather than starting from the opening price. News, such as after-hours announcements that would expose the market to open higher or lower next day would not be accounted for.

- ATR can be used with varying periods (daily, weekly, intraday etc.) however daily is typically the period used.

- It can be used to reinforce the belief in a move, if there a surge in the ATR after a bullish reversal then you might conclude there is power in this move up.

- After the spike at the open, ATR typically spends most of the day declining.

- He further refined the trading range, calling it a true range when he included changes in price that occurred from the previous day’s close rather than starting from the opening price.

- You should seek independent advice before trading if you have any doubts.

- This company trade reports majorly contain , Market analysis, Price analysis , Port analysis and trading partners.

It helps the day traders understand the risk and return potential of security and trade accordingly. For instance, if you are an aggressive trader who is trying to make use of the chances of high volatility, you could look for https://1investing.in/ a stock in which the ATR indicator shows a higher chance of volatility. At the same time, if you are looking for a less risky trade, you could look for a stock in which the average true range shows a lesser volatility chance.

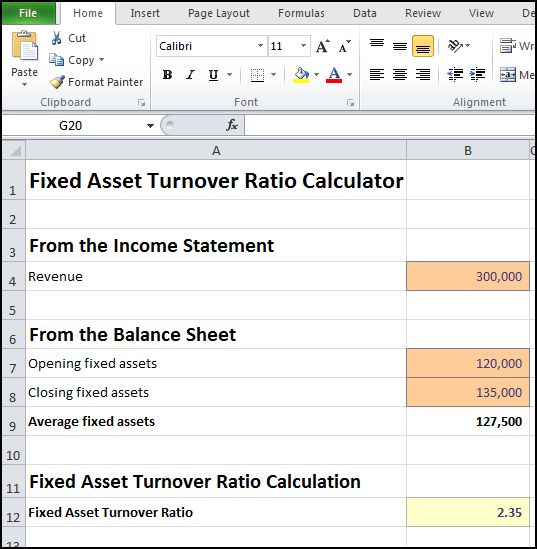

How to Calculate ATR?

The volatility and ATR of the markets is always changing. A bullish reversal with an increase in ATR would show strong buying pressure and reinforce the reversal. Investing.com – AptarGroup reported on Thursday third quarter erl-20979||earnings that matched analysts’ forecasts and revenue that fell short of expectations. The owners of the website and the website hereby waive any liability whatsoever due to the use of the website and/or information. Use of the website, the content and the information is made on the user’s sole liability. The user hereby releases the owners of the website from any liability for damage caused to his computer, in any, through the use of the website and/or its content and/or its various services.

In case you didn’t know, you can open your account online within 24 hours. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. The red line represents the average percentile for the last 240 periods.

Wilder also developed the Directional movement concept, Parabolic SAR and the RSI which are some of the most used indicators today. As a hypothetical example, assume the first value of the five-day ATR is calculated at 1.41 and the sixth day has a true range of 1.09. The sequential ATR value could be estimated by multiplying the previous value of the ATR by the number of days less one, and then adding the true range for the current period to the product. Traders can use shorter periods than 14 days to generate more trading signals, while longer periods have a higher probability to generate fewer trading signals. It is a tool that is used in conjunction with a strategy to help filter trades. It doesn’t necessarily predict anything but helps to determine the volatility of the stock.

Nifty, Sensex Open 2023 in Green: SGX Nifty, Dow, Nasdaq Futures

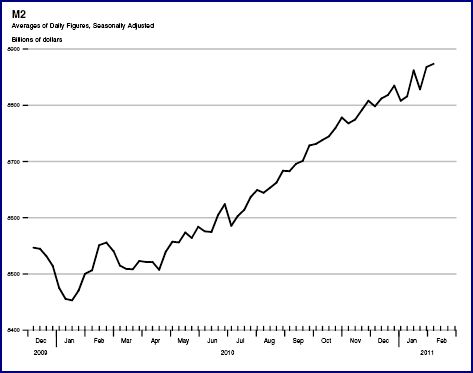

The major phases are accumulation, growth (mark-up), and distribution phase. To analyse these phases, market participants majorly understand the volatility, thus reducing the risks involved. Average True Range assists in recognizing the effect of volatility and helps to take advantage of unexpected movement. It is a technical indicator that measures market volatility. There is a well-known adage that in order to make money in the stock markets, there must be price movement.

The ATR indicator is a nice chart analysis tool for keeping an eye on volatility, which is a variable that is always important in charting or investing. It is a good option when trying to gauge the overall strength of a move or for discovering a trading range. That being said, it is an indicator that is best used as a complement to more price direction-driven indicators. Once a price move has begun, the Average True Range can add a level of confidence in that move, which can be beneficial for a trader.

Low volatility can be calculated by making a comparison of the daily range against a moving average over 10 days for that particular range. When the range today happens to be less than its 10-day average, then the range’s value may be added gfw court docket to its opening price and a breakout may be bought. When a stock breaks from its narrow range, it generally continues moving towards a breakout. Opening gaps usually pose the problem of hiding volatility when a daily range is looked at.

What is a Forex Indicator?

It’s truly an effective indicator that all market operators need to study diligently and which will only help them get the best results in the long term. Assume you take a long trade and the price is rising as you expect. A trailing stop loss gets you out if the price drops by a certain amount. In other words, it reduces risk or locks in a profit as the price moves in your favour. At the time of the trade, look at the current ATR reading.

This is an exclusive story available for selected readers only. “For example, a sudden move on the higher side of say 50 points may not affect the volatility number, but a move down in the same proportion will increase the volatility score,” he said. The blog posts/articles on our website are purely the author’s personal opinion. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice. Should you need such advice, consult a professional financial or tax advisor.

Fortunately, price movement is constant in the markets. Sometimes, the tone of the market is relatively quiet while on the other side of the spectrum, there are times when prices move at an above-average rate of speed. This speed, at which price moves, helps us to determine the volatility of an asset or an underlying. In simple terms, volatility can be described as ‘the speed at which price movements occur’.

“The difference between each equation is considered as a range and the true range is the maximum value of the three equations. The stop loss only moves to reduce risk or lock in a profit. If long, and the price moves favorably, continue to move the stop loss to 2 x ATR below the price.

Related posts

CFA vs CPA: Which Qualification is Better for You?

Forex Trading : 11.01.2023 : 0 ComentariiContent CPA Exam Education Requirements What Is a CPA? Difference Between CPA and CFA Is CFA harder than CPA? Or […]

Vantage FX Review 2023 Bonus, Demo & App Ratings

Forex Trading : 09.12.2022 : 0 ComentariiFurthermore, the company has provided a comparison between MT4 and MT5 platforms that might help traders have a broader view. […]

Kurs Bitcoin 75029 BTC PLN Notowania, najwyższa cena, wykresy, historia

Forex Trading : 29.08.2022 : 0 ComentariiContents 09-26 09:59 | Dział Analiz Makroekonomicznych Alior Bank S.A. Kurs dolara (USD) i ceny gazu zaskoczyły: ogromne wzrosty. Nowe […]

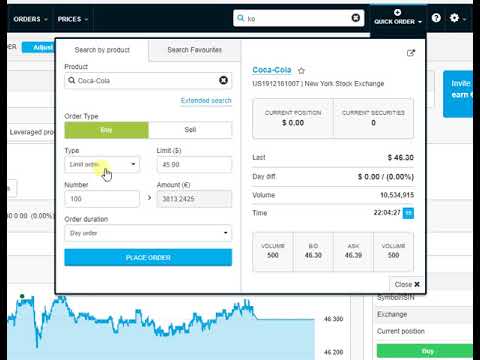

Bid and Ask Price Explained Heres What You Need To Know

Forex Trading : 22.07.2022 : 0 ComentariiAccess to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or […]